Life Insurance Calculator in Excel

A Life Insurance Calculator in Excel is a simple way to understand two things: how much life insurance coverage you may need and what a specific policy might be worth over time. Our free Excel template includes both of these calculations in the same file. You can use it directly as a spreadsheet or upload the file to Molnify to turn it into a secure, easy-to-use web app that you can share with anyone.

The template uses standard Excel logic and formulas and is easy to adjust to your market or your assumptions.

What You Get in the Life Insurance Excel Template

Coverage Needed – Excel Calculator Inputs and Outputs

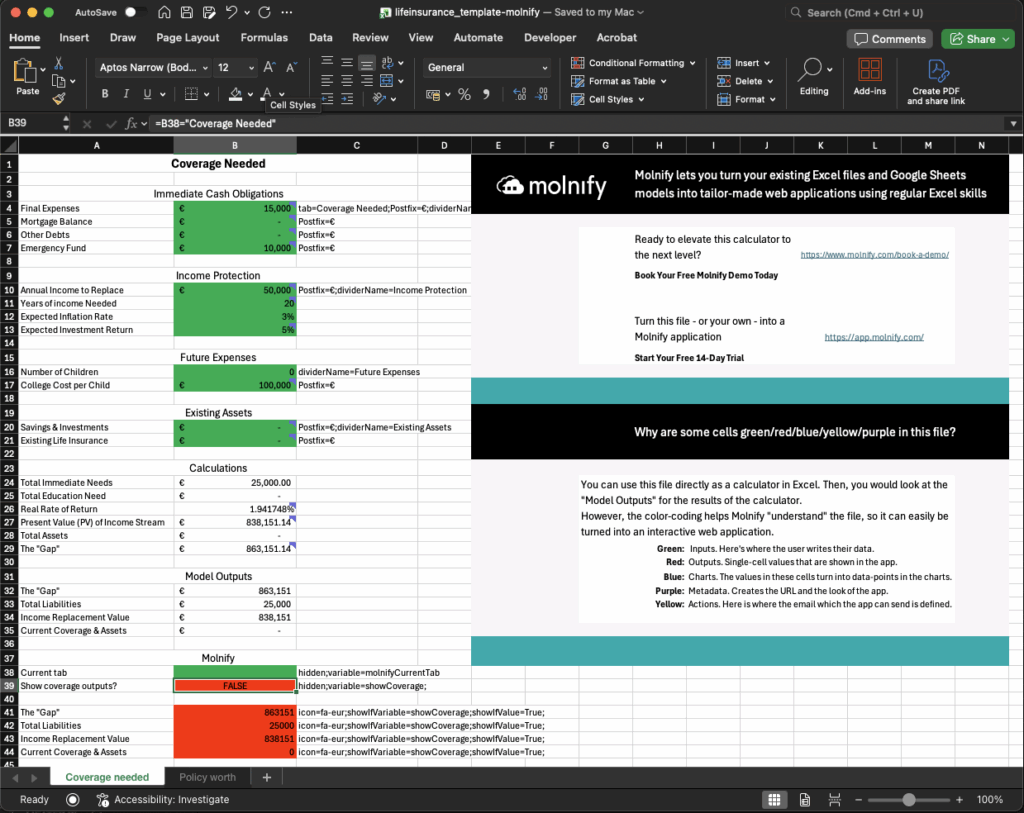

This sheet helps you estimate a reasonable coverage level. It combines immediate costs, income replacement, future expenses and your existing assets.

There are no charts in this worksheet. Everything is calculated directly in the cells so you can follow the logic step by step.

- Final expenses

- Mortgage balance

- Other debts

- Emergency fund

- Annual income to replace

- Number of years

- Inflation

- Expected investment return

- Number of children

- Education cost per child

- Savings and investments

- Existing life insurance

Outputs include:

- Total immediate needs

- Total future expenses

- Present value of income replacement

- Total assets

- Total liabilities

- Coverage gap

Policy Value – Long-Term Projections in Excel

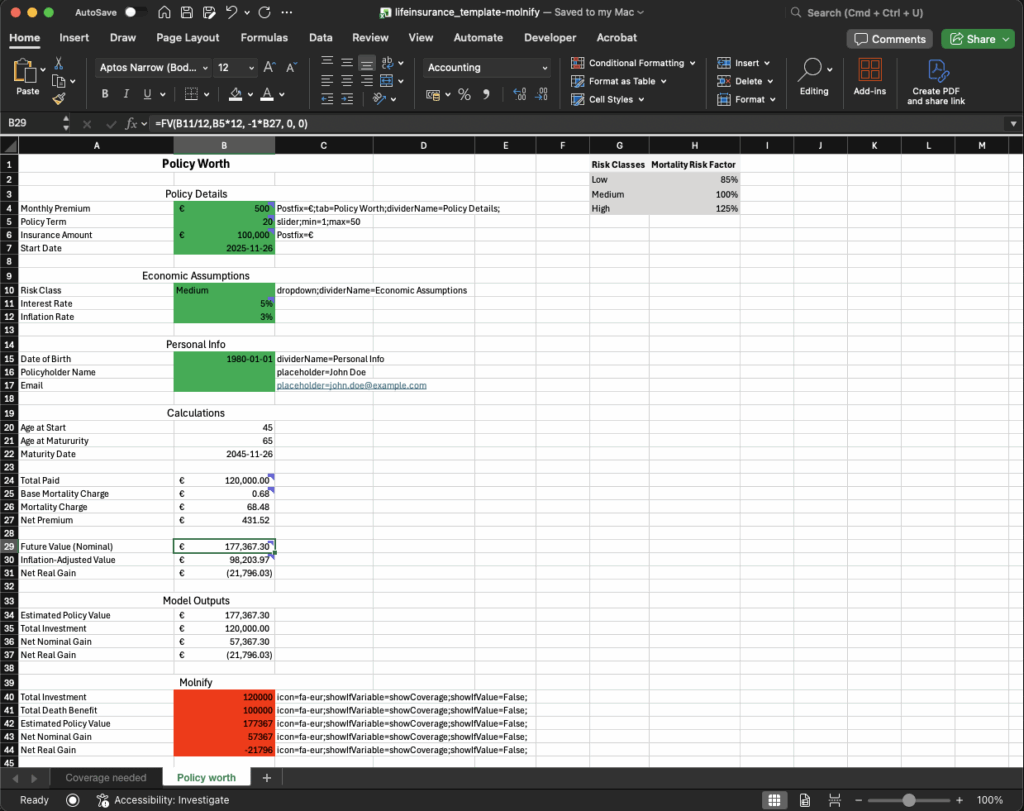

This sheet estimates the long-term value of a specific life insurance policy.

Inputs include:

- Monthly premium

- Policy term

- Insurance amount

- Start date

- Risk class (Low, Medium or High)

- Interest rate

- Inflation rate

The worksheet also includes a simple year-by-year projection table that feeds the line chart you see in the Molnify version of the app. The chart shows accumulated premiums, nominal value, real value and the death benefit.

Outputs include:

- Total premiums paid

- Estimated policy value (nominal)

- Estimated value adjusted for inflation

- Net nominal gain

- Net gain after inflation

- Age at start and age at maturity

- Maturity date

How the Excel File Is Structured in the Molnify Format

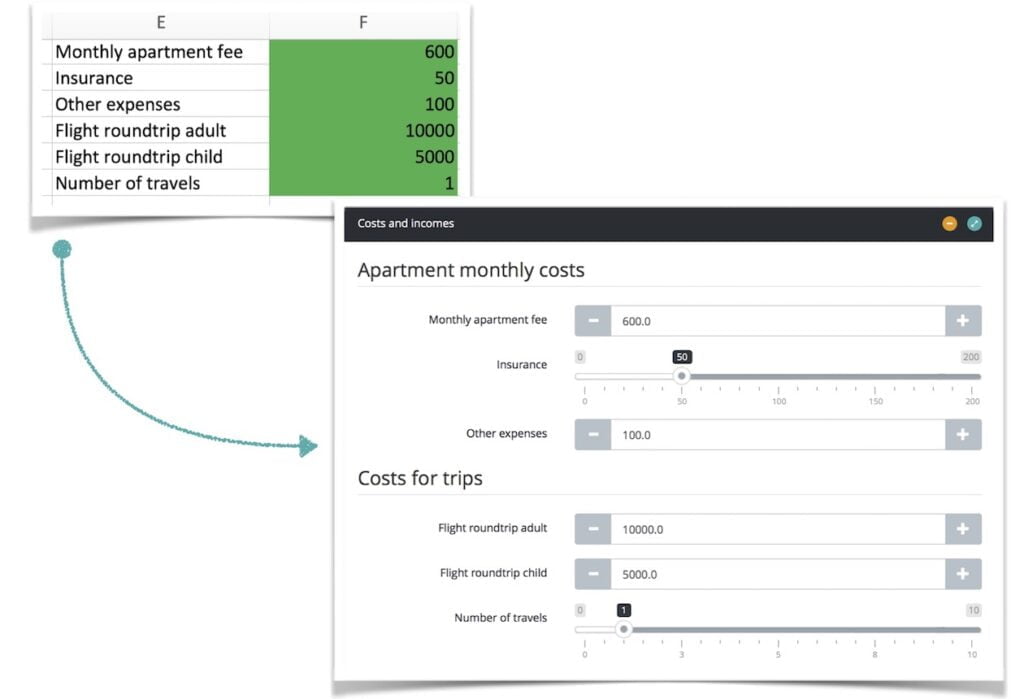

You can treat this like any other Excel workbook. All logic is transparent, and you can adjust the formulas if you want to expand the model or use your own assumptions.

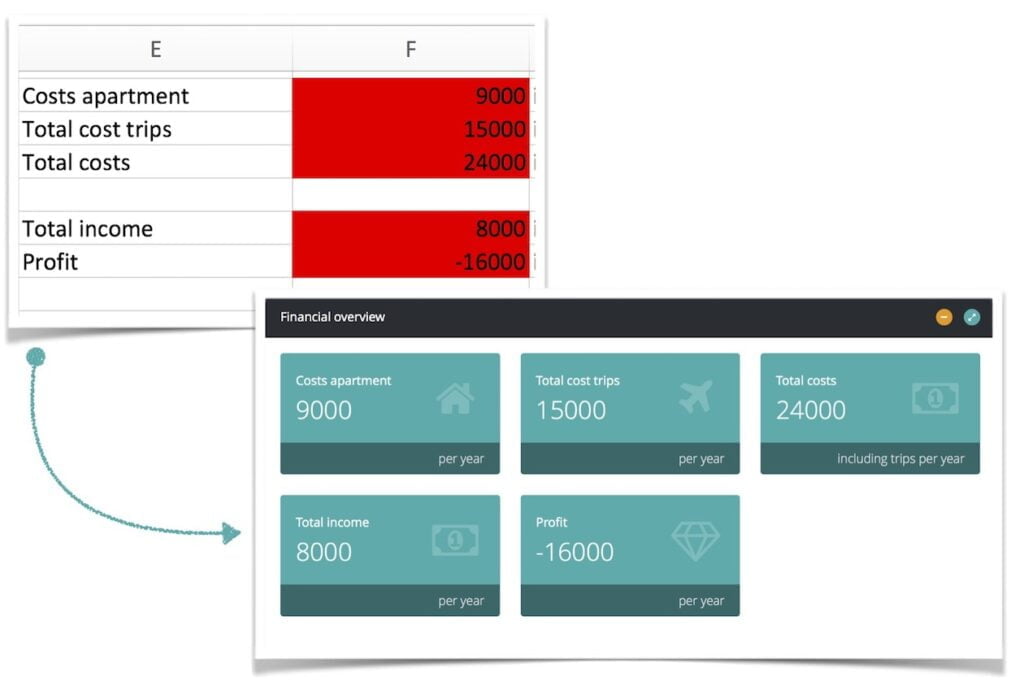

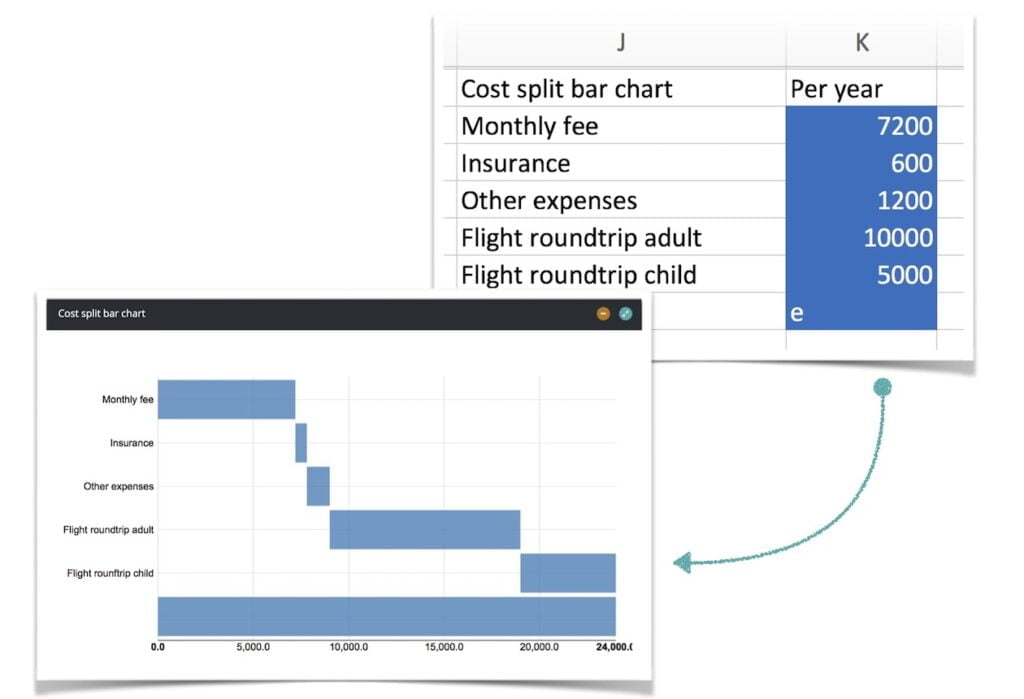

The template also follows Molnify’s color structure:

- Green cells are inputs

- Red cells are outputs

- Blue cells are chart data

- Yellow cells trigger actions in the Molnify app, such as sending an email

- Purple cells store metadata used by Molnify (for example app ID)

The color structure is optional if you only use the file in Excel. It exists so the same file can be uploaded to Molnify and automatically converted into a working application without needing any code.

Why Convert an Excel Calculator Into a Web App

The benefits of turning an Excel model into a web app using Molnify are many. As an app, you show only the inputs and outputs that you want to show, Excel formulas, equations and underlying data remain hidden.

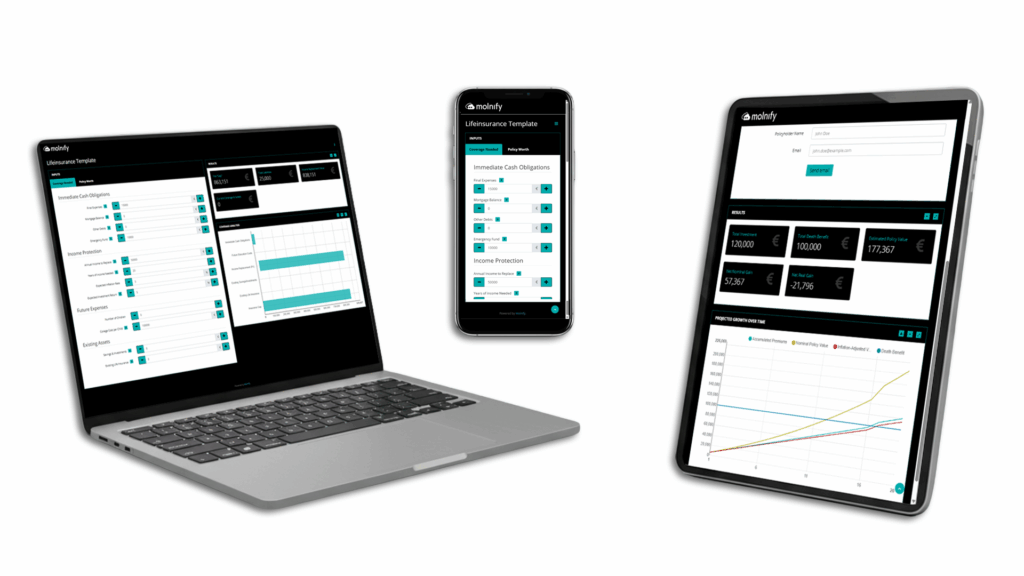

The app becomes easy to use on a laptop, tablet or mobile phone and sharing it with others is a breeze. When many people use the app at the same time, they all work independently without interfering with each other.

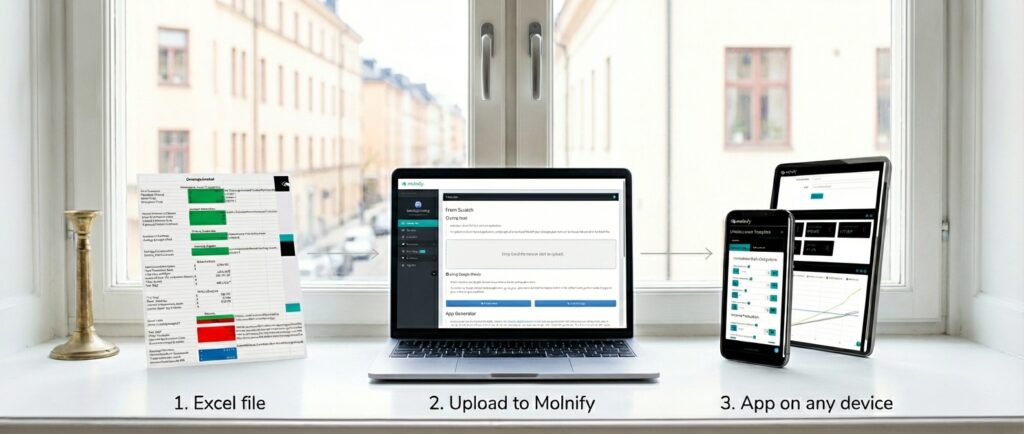

How to Turn the Excel Template Into a Molnify Web App

If you upload the file to Molnify, it becomes a web app in a second or two. The app will have:

- A tab for Coverage needed

- A tab for Policy worth

- Clean input fields matching the green cells

- A results section based on the red cells

- A line chart for the policy projection

- Support for mobile and desktop

- Optional actions such as sending the calculation to a client by email

The formulas stay exactly the same. You keep the flexibility of Excel while giving yourself or your clients a simpler way to use the calculator without sharing spreadsheets.

Download the Free Life Insurance Excel Template

Download the free Life Insurance Excel template

The Excel template contains both worksheets, all formulas and the same structure as the live Molnify app.

After you have downloaded the file, you can make adjustments as you please and make it your own.

To turn it into an app, go to app.molnify.com and register a FREE Molnify account. After registration, click Create app and drop your Excel file in the upload box. In about 1-3 seconds, your new app is ready to use.

Uploading the file starts a 14-day FREE trial. After the 14 days are up, you can either register a subscription for your app, or, you can take it offline and it won’t be charged.

You can, of course, still use the free Excel template for as long as you wish.

Summary – What This Excel Life Insurance Calculator and Web App Can Do

This Life Insurance Calculator in Excel gives you two tools in one file: a coverage-needs estimate and a policy-value projection. The logic is clear, the structure is simple and you can use the file as an ordinary spreadsheet or as a web app through Molnify.

If you want to expand or customize the model, you can do that directly in Excel and then upload the updated file again. Molnify will generate a new version of the app automatically.

Video Tutorial – How to Build a Web App from Excel

- Excel to web app and the basics of

- Input cells

- Equations and outputs

- How to create charts

- How metadata works

- How to upload your Excel file to Molnify

FAQ – Life Insurance Calculator in Excel

1. How accurate is this Excel life insurance calculator?

It provides general estimates only and is not financial advice.

2. Can I change the assumptions in the Excel template?

Yes. All formulas are visible, and you can adjust income, inflation, investment return, and policy parameters.

3. Can the calculator handle different policy types?

The template supports flexible inputs but does not model every product type. It’s meant for general planning.

4. Can I use the file without creating a Molnify app?

Yes. It works as a normal Excel spreadsheet. Molnify is optional.

5. Does Molnify store personal insurance data?

Only if you build your own app for it. The downloadable template stores nothing.

Disclaimer

Molnify is not a life insurance provider and does not offer financial advice. The Life Insurance Calculator and this article are only examples showing how an Excel model can be turned into a web app. They are not designed for real-life insurance decisions.

Do not base any financial or insurance decisions on this tool or this article. Always contact a qualified advisor or your insurance company for accurate guidance.

About Molnify

Molnify is a SaaS platform where you build web applications directly in Excel or Google Sheets using standard Excel functions and formulas. When you upload the file, Molnify converts it into a fully functional web app in 1-2 seconds. No plugins, no custom coding language and no separate interface.

Advanced logic can be added in the same spreadsheet through HTML, CSS, JavaScript, SQL and API requests, making it possible to create complex business tools, automations and integrations. The generated app can be used on any device.

Companies use Molnify to build pricing tools, quote systems, ROI calculators, dashboards, data collection tools and internal workflows without traditional software development. No programming skills needed, basic Excel skills are enough.