Insurance Calculators

Insurance Calculators & Quote Tools

Calculating insurance premiums, generating quotes, or estimating costs shouldn’t mean wrestling with static spreadsheets. With Molnify, you can turn your Excel-based insurance calculators, premium estimators, and quote tools into smart, interactive web apps. Automate complex pricing, cut out versioning headaches, and give your team or customers an effortless way to get instant, accurate insurance quotes online — no messy formulas, no back-and-forth emails.

What is an Insurance Calculator?

An insurance calculator is a tool that helps you estimate the cost of an insurance policy based on key factors like coverage, risk, and premium formulas. It can be as simple as a basic cost estimator — or as advanced as a full online premium calculator and quote tool that handles customer inputs, discounts, taxes, and policy options in real time.

A good insurance calculator does more than crunch numbers — it makes it simple for your team or your customers to see how prices are calculated, test different scenarios, and get instant quotes without messy spreadsheets or endless email threads.

A typical insurance calculator includes:

- Policy coverage details and limits

- Risk factors and assumptions

- Premium or cost formulas

- Discounts, taxes, and fees

- Instant quote output or application summary

Why Insurance Calculators Matter (and Quote Tools Too)

Insurance calculators do more than just crunch numbers — they make your pricing process faster, clearer, and more reliable. By turning complex coverage and risk factors into clear, real-time estimates, they help you avoid errors, protect your margins, and build trust with your customers.

A good quote tool takes it a step further. It lets prospects customize their coverage, see exactly how their choices affect the premium, and get an instant, accurate quote — no waiting for back-and-forth emails or manual spreadsheet tweaks.

Together, smart calculators and quote tools make your insurance products easier to understand and buy. They help you move faster, reduce mistakes, and deliver the kind of transparent experience today’s customers expect.

Common Challenges with Insurance Calculators

Building and sharing insurance calculators might sound simple — but in reality, many teams run into the same headaches. Here are a few common issues:

- Complex rules: Insurance pricing often depends on detailed risk factors, policy conditions, or local regulations that are tricky to keep up to date in a spreadsheet.

- Error-prone updates: Small changes to rates or coverage can break formulas — one mistake can lead to underpricing or compliance issues.

- Limited self-service: Static spreadsheets can’t give customers an easy, guided way to test coverage options or adjust policy details themselves.

- Difficult integrations: Linking your calculator to other systems — like underwriting, CRM, or digital signature tools — is nearly impossible with a file-based setup.

- Version headaches: Multiple versions floating around makes it hard to know which one is correct — and outdated quotes can cause big trust issues.

All together, these challenges hold your team back from offering fast, clear, and compliant quotes that build trust and close sales.

Why Turn Your Insurance Calculator into a Web App with Molnify?

If you’re still using Excel for insurance quotes and premium calculations, you’re not the only one — but there’s a better way. Molnify lets you turn those static spreadsheets into user-friendly web apps that automate pricing, stay up to date, and make quoting easy for everyone.

Here’s why teams make the switch:

- Seamless website integration: Embed your calculator directly on your website with an iframe — no extra logins or clunky file downloads.

- Customer-first design: Let customers adjust coverage, add options, or see real-time premium changes — all in one smooth flow.

- Faster buying process: Connect your quote tool to e-signature services like Adobe Sign to close deals securely online — no paper, no waiting.

- Easy updates: Update your premium or risk models once, and every app reflects the change instantly — no version mix-ups.

- Rapid product launches: Test and roll out new insurance products faster, so you can adapt to changing markets and customer needs without big IT projects.

By moving your Excel insurance calculators to Molnify, you protect your pricing logic, speed up sales, and give your customers the clear, modern experience they expect.

Example Insurance Calculator App

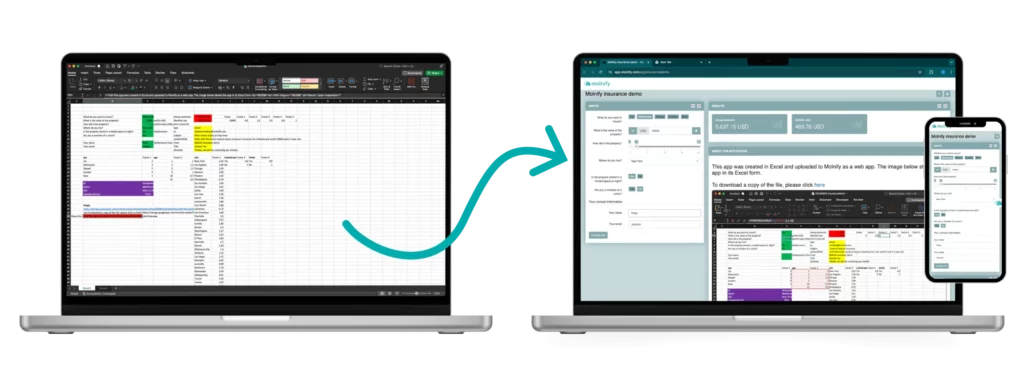

See how a real insurance calculator works as a web app with Molnify. This example lets customers enter key details — like what they want to insure, property value, age, and location — and instantly see the calculated premium and monthly cost.

Built in Excel and turned into an interactive app, this demo shows how easy it is to move complex premium logic online. Customers can adjust inputs, compare scenarios, and submit their contact details — all without handling static files or manual spreadsheets.

FAQ

How does an insurance calculator work?

An insurance calculator uses key details — like coverage, risk factors, and policy rules — to estimate premium costs automatically. It replaces manual spreadsheets with instant, accurate calculations customers can trust.

What’s the difference between an insurance calculator and a quote tool?

An insurance calculator does the math behind premiums and costs. A quote tool takes that calculation and turns it into an instant, personalized quote for your customer — often with options to adjust coverage and see pricing updates in real time.

Can I build an insurance calculator in Excel?

Yes — many insurance teams start in Excel because it’s flexible for premium formulas. But sharing spreadsheets often leads to errors, version conflicts, and a poor customer experience. Molnify helps you turn that static file into a secure web app that’s always up to date.

Why put an insurance calculator online?

Putting your calculator or quote tool online makes it easier for customers to check prices, customize coverage, and get quotes instantly — without emailing back and forth. It also keeps your pricing logic secure and consistent.

Who uses insurance calculators?

Insurers, brokers, agents, and insurtech teams all use calculators and quote tools to handle premium estimates, generate quotes quickly, and give customers a clear, easy way to see costs before buying.

Bring Your Insurance Calculators Online

Your customers expect clear, instant quotes. Molnify makes it easy — turn your insurance calculators into web apps that do the work for you.